On January 17, 2018, Airbnb announced they would begin collecting and remitting taxes in Tennessee:

Great news! If you have a listing in Tennessee State, Airbnb will start remitting the following tax(es) for all reservations booked on or after March 01, 2018:

- State Sales Tax

- Local Sales Tax

Guests will see a separate line item for the tax(es) when booking. Airbnb will collect and pay the tax(es) to the jurisdiction at the next filing due date.

Airbnb called this “seamless and easy.”

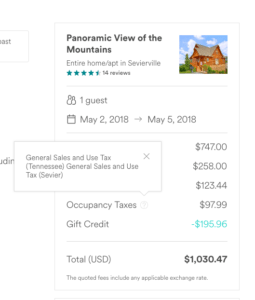

They backed this up with documentation provided to our team. The Airbnb US South Support Team e-mailed us a description of the taxes they would collect for us, and they showed us a screenshot of our booking page:

They backed this up with documentation provided to our team. The Airbnb US South Support Team e-mailed us a description of the taxes they would collect for us, and they showed us a screenshot of our booking page:

Here is what we collect and remit:

- Sevier County – Local Sales and Use – 2.75%

- Tennessee State – Sales and Use – 7%

- Total – 9.25%

However, when we crunched the numbers, we realized this doesn’t cover every tax. This only applies to state-collected sales and use tax, not occupancy taxes such as the 3% that goes to Gatlinburg or the 3% that goes to Sevier County. These are collected locally.

We talked with the State of Tennessee’s Department of Revenue and Sevier County to gain clarification.

You will need to contact your local tax expert to confirm your specific case, as Airbnb is not able to offer individualized assistance on tax questions. You can also contact:

- Tennessee Department of Revenue: (615) 253-0600

- Gatlinburg Department of Finance Business Taxes and Licenses: Kindra Smith, (865) 436-1405

- Sevier County Trustee: (865) 453-2767

You can download tax reports from within Airbnb’s dashboard to see how much tax is being submitted on your behalf.